Royalty NFT

Metaverse

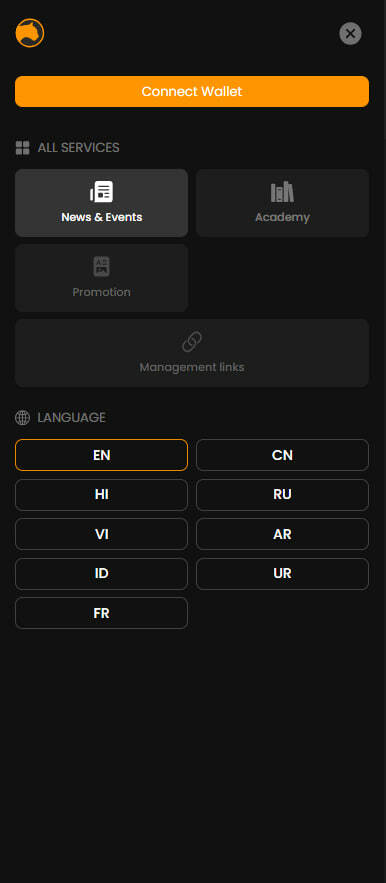

All Services

OTHER

COMING SOON

Management links

COMING SOON

Promotion

ALL SERVICES

LANGUAGE

Style

Bitcoin, which changed the world!

In 2011, one of the world's most famous white hat hackers, Dan Kaminsky, who had previously discovered a critical vulnerability in the DNS protocol, decided to hack Bitcoin.

He was fully confident in his abilities:

"I have never seen anything like it. This is a world-class programmer with deep knowledge of C++. He understands economics, cryptography, and peer-to-peer networks. Either this is a whole team, or this guy is a genius," the hacker concluded.

Kaminsky developed nine approaches to attack the protocol, but each time he encountered the same message: "Attack Removed."

"The code formatting was simply insane. Only the most paranoid and meticulous programmer on the planet could avoid mistakes," he said at the time."

.....On October 31, 2008, an unknown person using the pseudonym Satoshi Nakamoto published the article "Bitcoin: A Peer-to-Peer Electronic Cash System." In this article, he described the future Bitcoin protocol - a set of rules that the created system should follow.

Satoshi Nakamoto introduced Bitcoin to the world by sharing his famous white paper. His invention, published on the cryptography mailing list on metzdowd.com, not only solved a problem that had plagued computer scientists for years but also completely changed how people understand money.

As a side effect, Satoshi Nakamoto's invention gave birth to a new digital economy with over 13,000 cryptocurrencies, whose combined value today exceeds $1 trillion.

Satoshi Nakamoto introduced Bitcoin to the world by sharing his famous white paper. His invention, published on the cryptography mailing list on metzdowd.com, not only solved a problem that had plagued computer scientists for years but also completely changed how people understand money.

As a side effect, Satoshi Nakamoto's invention gave birth to a new digital economy with over 13,000 cryptocurrencies, whose combined value today exceeds $1 trillion.

The Bitcoin white paper was born on October 31, 2008, around 14:10 (Eastern Standard Time).

This date marks a new stage in the development of the money of the future, and the first proposal written by the inventor of Bitcoin was:

"I've been working on a new electronic cash system that's fully peer-to-peer, with no trusted third party."

In his message, the creator of Bitcoin stated that the advantages of Bitcoin include preventing double spending and "the absence of an issuing center or other trusted parties; bitcoins are issued through proof-of-work in the style of Hashcash."

Since then, Satoshi has not appeared in the network until four days later when he published two more emails on November 3, 2008. Both emails served as an introduction to the "Bitcoin White Paper" with a brief summary and a URL link to where the article could be read.

Satoshi wrote a total of 16 emails (some of them were responses to James A. Donald) in 2008 before the network actually launched on January 3, 2009.

After the network launched on January 3, 2009, Satoshi did not communicate through the mailing list until January 8, 2009, when his message titled "Bitcoin v0.1 Released" appeared. In this post, the inventor of Bitcoin stated:

"We announce the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending. It's completely decentralized, with no server or central authority."

It is believed that the inventor of Bitcoin mined between 750,000 and 1.1 million BTC before leaving the community in 2010. It is also believed that Satoshi may have mined all these coins using a single computer.

Since then, Satoshi has not appeared in the network until four days later when he published two more emails on November 3, 2008. Both emails served as an introduction to the "Bitcoin White Paper" with a brief summary and a URL link to where the article could be read.

Satoshi wrote a total of 16 emails (some of them were responses to James A. Donald) in 2008 before the network actually launched on January 3, 2009.

After the network launched on January 3, 2009, Satoshi did not communicate through the mailing list until January 8, 2009, when his message titled "Bitcoin v0.1 Released" appeared. In this post, the inventor of Bitcoin stated:

"We announce the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending. It's completely decentralized, with no server or central authority."

It is believed that the inventor of Bitcoin mined between 750,000 and 1.1 million BTC before leaving the community in 2010. It is also believed that Satoshi may have mined all these coins using a single computer.

This was the first time in history that the academic and computer science communities were presented with a document that solved the "Byzantine Generals' Problem" or "Byzantine Fault." It also presented the first scientific paper showing how triple-entry accounting works.

Even then, Nakamoto knew it was a breakthrough invention, stating on November 13, 2008:

Even then, Nakamoto knew it was a breakthrough invention, stating on November 13, 2008:

"The blockchain proof-of-work is a solution to the Byzantine Generals' Problem. It should be noted that the POS Protocol does not fully solve this problem, no matter how elegantly the theoretical calculations of its supporters may appear."

Nakamoto already knew that this breakthrough invention was, stating on November 13, 2008:

The blockchain proof-of-work is a solution to the Byzantine generals' problem. It should be added that the POS protocol does not fully solve this problem, no matter how elegant the theoretical calculations of its supporters may look.

From a value of $1 trillion in the crypto economy, Satoshi Nakamoto's invention now accounts for almost 38% of the total volume today. It is worth considering whether the white paper of Bitcoin was released on Halloween by chance.

All parts of the system were known before Nakamoto. Cryptographic algorithms underlying Bitcoin already existed. Distributed data storage in decentralized networks was also used.

Nakamoto's genius was in putting together separate pieces into a whole, building a system and making it work. The proposed system was truly revolutionary, and nothing like it had existed before.

Satoshi Nakamoto said:

"We proposed a system of electronic transactions where no one needs to trust anyone."

Soon after the protocol was published, on January 3, 2009, the first block in the blockchain was generated by Satoshi. At that moment, the first 50 bitcoins were mined.

In general, Satoshi Nakamoto personally mined the first bitcoins during 2009. He supported the network. Therefore, to this day, there are about 1 million bitcoins on wallets that are believed to belong to him.

So, the "father of Bitcoin" is Satoshi Nakamoto. However, to this day, no one knows who he really is. There are many versions on this topic:

- An enthusiast - a loner;

- Group of scientists;

- A fictional character hiding behind intelligence agencies;

- Illuminati, Masons, aliens, reptilians. For fans of the "conspiracy theory," any option can be chosen.

The fact remains - the personality of Satoshi Nakamoto is still unknown.

The last message from "Satoshi" - whoever is hiding behind this pseudonym - was received on December 12, 2010. After that, he disappeared from the network and did not participate in the further development of Bitcoin or any other activity...

This is the story of the emergence of Bitcoin.

The Emergence of Bitcoin

After the emergence of Bitcoin, its development began rapidly.

The first Bitcoin transaction occurred on January 12, 2009.

Just nine months later, on October 5, 2009, the first exchange rate for Bitcoin was established. On the New Liberty Standart website, one could exchange 1 dollar for 1,309.03 bitcoins.

In other words, for 1 cent, you could buy 13 bitcoins! You can compare this figure with today's exchange rate and understand how much Bitcoin has grown over time.

On May 22, 2010, a real breakthrough occurred! Bitcoins were exchanged for real goods for the first time.

An American named Laszlo Hanyecz received two pizzas for 10,000 bitcoins

This was a truly revolutionary event.

Bitcoin ceased to be purely a virtual phenomenon and entered the real world.

The Bitcoin community regularly celebrates Bitcoin Pizza Day on May 22 in honor of this event. And if you join the ranks of cryptocurrency users, you will have one more holiday to celebrate!

Bitcoin ceased to be purely a virtual phenomenon and entered the real world.

The Bitcoin community regularly celebrates Bitcoin Pizza Day on May 22 in honor of this event. And if you join the ranks of cryptocurrency users, you will have one more holiday to celebrate!

Great Rises and Falls of Bitcoin

Bitcoin continued to gain strength.

In November 2010, the total capitalization of Bitcoin exceeded $1 million.

In February 2011, the price of Bitcoin was compared to the dollar. In just a year and a half, the price of Bitcoin increased by 1,300 times! Perhaps this is an absolute record in world history and an important moment in the history of Bitcoin.

In June 2011, the organization "WikiLeaks," led by one of the world's fighters for truth, Julian Assange, began accepting donations in Bitcoin.

The US was waging a relentless battle against Assange, trying to prevent his publications. Therefore, at the request of US authorities, Assange's accounts in euros and dollars were blocked, transfers through Visa and Mastercard were blocked, as well as through PayPal. However, even the almighty US couldn't influence Bitcoin transfers, and "WikiLeaks" continued its work.

This proves the complete independence and functionality of Bitcoin as a system. Nevertheless, in June 2011, the first great correction of Bitcoin began: its price fell 16 times, from $32 to $2 and returned to the achieved price level only after 1.5 years, in February 2013.

In general, in the history of Bitcoin during its existence, there have been seven cases of price drops from the maximum reached by 2 times or more. However, three cases deserve the name "great correction" due to their long duration, which was more than a year...

At the beginning of 2013, Bitcoin overcame the consequences of the first great correction.

This proves the complete independence and functionality of Bitcoin as a system. Nevertheless, in June 2011, the first great correction of Bitcoin began: its price fell 16 times, from $32 to $2 and returned to the achieved price level only after 1.5 years, in February 2013.

In general, in the history of Bitcoin during its existence, there have been seven cases of price drops from the maximum reached by 2 times or more. However, three cases deserve the name "great correction" due to their long duration, which was more than a year...

At the beginning of 2013, Bitcoin overcame the consequences of the first great correction.

This happened largely due to the financial crisis in Cyprus

In Cyprus, one of the world's offshore havens, in March 2013, authorities decided to freeze bank deposits and forcibly confiscate money from depositors. One of the ways to save funds was Bitcoin. Thanks to this, in March 2013, the capitalization of Bitcoin exceeded $1 billion for the first time.

Meanwhile, in October 2013, the world's first Bitcoin ATM (bitcoinnat) opened in Canada. Bitcoin takes another step towards being recognized as "money."

At the end of that year, the price of Bitcoin began to rise sharply. In November 2013, the price of BTC briefly exceeded $1,000.

However, the rise was short-lived. The second great correction of Bitcoin followed. During this correction, the price fell by 7 times, to $170. The price did not recover to the $1,100 level until more than three years later, in February 2017.

At the end of that year, the price of Bitcoin began to rise sharply. In November 2013, the price of BTC briefly exceeded $1,000.

However, the rise was short-lived. The second great correction of Bitcoin followed. During this correction, the price fell by 7 times, to $170. The price did not recover to the $1,100 level until more than three years later, in February 2017.

During this time, Bitcoin was repeatedly predicted to meet its demise. However, despite the price drops, Bitcoin continued to spread and the blockchain technology continued to develop.

The pinnacle of Bitcoin's acceptance in the world came in March 2016, when it was recognized as a legal payment method in Japan. In the Land of the Rising Sun, it became money on par with the yen.

This event became a solid foundation for another rise. Throughout 2017, Bitcoin rapidly climbed upwards. In November 2017, the Bitcoin exchange rate surpassed another "round" mark at $10,000, followed by a rapid ascent to $20,000.

One result of this growing popularity was the opening of BTC futures trading on the Chicago Stock Exchange in December 2017.

However, this rise was followed by an inevitable rollback.

Bitcoin entered its third great correction. The price drop was sixfold, to the level of $3,200 USD.

However, as during previous declines, technology development and Bitcoin's spread continued. In 2018, the Lightning Network was launched on the Bitcoin network (a technology that will allow Bitcoin to become truly global money).

If this technology is successfully implemented, the most incredible predictions about Bitcoin reaching a value of $1 million or more in a few years may come true.

The pinnacle of Bitcoin's acceptance in the world came in March 2016, when it was recognized as a legal payment method in Japan. In the Land of the Rising Sun, it became money on par with the yen.

This event became a solid foundation for another rise. Throughout 2017, Bitcoin rapidly climbed upwards. In November 2017, the Bitcoin exchange rate surpassed another "round" mark at $10,000, followed by a rapid ascent to $20,000.

One result of this growing popularity was the opening of BTC futures trading on the Chicago Stock Exchange in December 2017.

However, this rise was followed by an inevitable rollback.

Bitcoin entered its third great correction. The price drop was sixfold, to the level of $3,200 USD.

However, as during previous declines, technology development and Bitcoin's spread continued. In 2018, the Lightning Network was launched on the Bitcoin network (a technology that will allow Bitcoin to become truly global money).

If this technology is successfully implemented, the most incredible predictions about Bitcoin reaching a value of $1 million or more in a few years may come true.

More about Bitcoin's prospects can be found here

In 2019, the largest trading platform Bakkt opened a service for the purchase and storage of Bitcoin for large institutional investors. The US Securities and Exchange Commission is barely keeping up with applications for the opening of an exchange-traded fund (ETF) based on Bitcoin. This sets the stage for truly big money to invest in the first cryptocurrency.

The third major correction of Bitcoin ended at the end of 2020, and the cryptocurrency began to rise again.

Bitcoin reached a new historical high of $67,000 USD, and large companies such as Tesla began to buy it.

The ban on Bitcoin and mining in China did not prevent it from reaching its maximum value, which confirms the system's resilience.

On September 7, 2021, BTC became a legal payment method in El Salvador.

Most importantly, the number of Bitcoin users continues to grow. By 2023, according to various estimates, the number of BTC users will be between 260 and 400 million people.

This is the story of Bitcoin from the very beginning. It is a story of incredible growth, which we are witnessing.

Bitcoin reached a new historical high of $67,000 USD, and large companies such as Tesla began to buy it.

The ban on Bitcoin and mining in China did not prevent it from reaching its maximum value, which confirms the system's resilience.

On September 7, 2021, BTC became a legal payment method in El Salvador.

Most importantly, the number of Bitcoin users continues to grow. By 2023, according to various estimates, the number of BTC users will be between 260 and 400 million people.

This is the story of Bitcoin from the very beginning. It is a story of incredible growth, which we are witnessing.

If you think about the fact that for 14 years there has been a financial system in the world that belongs to no one and remains accessible and reliable, you will understand why many bankers do not like Bitcoin.