Royalty NFT

Metaverse

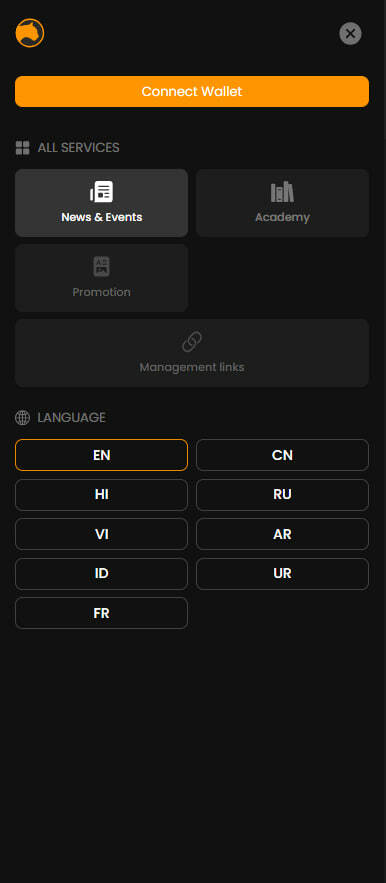

All Services

OTHER

COMING SOON

Management links

COMING SOON

Promotion

ALL SERVICES

LANGUAGE

Style

WHAT IS INCLUDED IN BLOCKCHAIN?

- BLOCKCHAIN INFRASTRUCTURE, SERVICES, AND COMPONENTS

- DECENTRALIZED FINANCE VS TRADITIONAL FINANCE

- RISKS OF DECENTRALIZED EXCHANGES

- DIFFERENCES BETWEEN TRADITIONAL FINANCE AND DECENTRALIZED FINANCE

- WHAT IS A SMART CONTRACT?

- HOW SMART CONTRACTS WORK

- ADVANTAGES OF SMART CONTRACTS

- WHAT IS NFT?

- LEADING CRYPTOCURRENCIES BY MARKET CAPITALIZATION

- WHAT IS POLYGON?

- MATIC

- CRYPTO WALLETS

Blockchain infrastructure, services, and components include:

1. Blockchain platforms: This is software that allows you to create and manage blockchains. Examples of such platforms are Ethereum, Bitcoin, Hyperledger, and others.

2. Cryptocurrencies: Blockchain is used to create and manage cryptocurrencies such as Bitcoin, Ethereum, Ripple, and others. Cryptocurrencies are a primary application of blockchain and allow for secure and transparent financial transactions.

3. Smart contracts: These are computer programs that automatically execute conditions and rules outlined in a contract. Smart contracts operate on the blockchain and enable secure and automated transactions without intermediaries.

4. Decentralized applications (DApps): These are applications that run on the blockchain and do not have centralized control or management. DApps provide various services such as financial services, social networks, games, and others.

5. Digital wallets: This is software or hardware devices that allow users to store and manage their cryptocurrency assets. Digital wallets provide secure storage of private keys and enable transactions on the blockchain.

6. Mining: This is the process of verifying and adding new transactions to the blockchain. Miners use their computing power to solve complex mathematical problems and receive rewards for their work.

7. Consensus algorithms: These are algorithms used to achieve agreement among blockchain participants on the state and order of transactions. Some of the most common consensus algorithms include Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS).

8. Application programming interfaces (APIs): These are sets of tools and protocols that allow developers to create applications that interact with the blockchain. APIs provide access to various blockchain functions and services.

2. Cryptocurrencies: Blockchain is used to create and manage cryptocurrencies such as Bitcoin, Ethereum, Ripple, and others. Cryptocurrencies are a primary application of blockchain and allow for secure and transparent financial transactions.

3. Smart contracts: These are computer programs that automatically execute conditions and rules outlined in a contract. Smart contracts operate on the blockchain and enable secure and automated transactions without intermediaries.

4. Decentralized applications (DApps): These are applications that run on the blockchain and do not have centralized control or management. DApps provide various services such as financial services, social networks, games, and others.

5. Digital wallets: This is software or hardware devices that allow users to store and manage their cryptocurrency assets. Digital wallets provide secure storage of private keys and enable transactions on the blockchain.

6. Mining: This is the process of verifying and adding new transactions to the blockchain. Miners use their computing power to solve complex mathematical problems and receive rewards for their work.

7. Consensus algorithms: These are algorithms used to achieve agreement among blockchain participants on the state and order of transactions. Some of the most common consensus algorithms include Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS).

8. Application programming interfaces (APIs): These are sets of tools and protocols that allow developers to create applications that interact with the blockchain. APIs provide access to various blockchain functions and services.

These are just some of the main services and components included in blockchain infrastructure. Depending on specific needs and applications, there may be other blockchain-related services and components.

Decentralized finance versus traditional finance

Slow speed and high fees, inaccessibility and regulatory uncertainty are some of the main problems that plague the current banking system.

Unfortunately, not everyone has the privilege of access to the current financial system – people who do not have this access are inherently disadvantaged.

The DeFi movement aims to eliminate these differences and provide financial accessibility for all, without any form of censorship.

In short, DeFi opens up huge opportunities and allows users to access various financial instruments without any restrictions based on race, religion, age, nationality or geography.

Unfortunately, not everyone has the privilege of access to the current financial system – people who do not have this access are inherently disadvantaged.

The DeFi movement aims to eliminate these differences and provide financial accessibility for all, without any form of censorship.

In short, DeFi opens up huge opportunities and allows users to access various financial instruments without any restrictions based on race, religion, age, nationality or geography.

DeFi is not a single product or company, but a set of products and services that replace such financial institutions as banks, insurance companies, bond markets and money markets. Decentralized financial applications allow users to combine their services, opening up a multitude of possibilities.

DeFi applications have the potential to revolutionize traditional financial services by eliminating the need for intermediaries.

Risks of Decentralized Exchanges

Decentralized exchanges also have their own risks. Here are some of them:

Overall, as with any type of exchange, using decentralized exchanges also requires caution and taking steps to protect your assets. This may include checking the security of smart contracts, using reliable wallets, and carefully selecting an exchange to trade with.

- Low liquidity: Decentralized exchanges typically have lower liquidity than centralized exchanges. This means that it can be difficult to find a counterparty to trade with, especially for large volumes.

- High fees: Some decentralized exchanges may charge high fees for executing trades. This can be due to limited liquidity and additional costs of ensuring the security and efficient operation of the platform

- Lack of regulation: Decentralized exchanges are typically not regulated by government or financial authorities, which means that users do not have the same level of protection and legal recourse that centralized exchanges may offer.

- Smart contract vulnerabilities: Decentralized exchanges often use smart contracts to execute trades. However, these smart contracts can contain vulnerabilities that can be exploited by malicious actors to commit fraud or hacks.

- Lack of support: As decentralized exchanges do not have a central operator, users may encounter problems that can be difficult to resolve without support from the platform.

Overall, as with any type of exchange, using decentralized exchanges also requires caution and taking steps to protect your assets. This may include checking the security of smart contracts, using reliable wallets, and carefully selecting an exchange to trade with.

SECURITY OF USING DECENTRALIZED EXCHANGES:

1. Research the exchange: Do research about the exchange, read the reviews and ratings of other users. Learn about its reputation and security history.

2. Check the security of smart contracts: Before using a decentralized exchange, make sure that the smart contracts used on the platform have passed the security audit. This will help reduce the risk of vulnerabilities and loss of funds.

3. Use secure wallets: Store your cryptocurrency assets in secure wallets that support multiple layers of security such as two-factor authentication and cold storage.

4. Understand the process of transactions: Understand how a decentralized exchange works and what steps need to be taken to complete transactions. Make sure you are familiar with the process and don't make any mistakes that could lead to loss of funds.

5. Diversify your investments: Don't put all your funds on one decentralized exchange. Diversify your investments and use multiple exchanges to complete transactions.

6. Watch out for phishing: Be alert to fake websites and scam attempts. Always check the website URL and make sure you are using an official and secure source.

7. Update your software: Make sure you always use the latest software for your wallet and other tools to reduce the risk of vulnerabilities.

8. Use Two-Factor Authentication: Enable two-factor authentication for your decentralized exchange accounts for an extra layer of security.

9. Be careful with public keys: Never share your public keys or personal data with unverified sources. This may result in unauthorized access to your accounts.

10. Follow the news: Stay up to date with the latest news and events in the world of cryptocurrencies to be aware of possible threats and risks.

By following these guidelines, you can increase the security of your assets when using decentralized exchanges. However, remember that risk is always present, so be careful and attentive when making any financial transactions.

2. Check the security of smart contracts: Before using a decentralized exchange, make sure that the smart contracts used on the platform have passed the security audit. This will help reduce the risk of vulnerabilities and loss of funds.

3. Use secure wallets: Store your cryptocurrency assets in secure wallets that support multiple layers of security such as two-factor authentication and cold storage.

4. Understand the process of transactions: Understand how a decentralized exchange works and what steps need to be taken to complete transactions. Make sure you are familiar with the process and don't make any mistakes that could lead to loss of funds.

5. Diversify your investments: Don't put all your funds on one decentralized exchange. Diversify your investments and use multiple exchanges to complete transactions.

6. Watch out for phishing: Be alert to fake websites and scam attempts. Always check the website URL and make sure you are using an official and secure source.

7. Update your software: Make sure you always use the latest software for your wallet and other tools to reduce the risk of vulnerabilities.

8. Use Two-Factor Authentication: Enable two-factor authentication for your decentralized exchange accounts for an extra layer of security.

9. Be careful with public keys: Never share your public keys or personal data with unverified sources. This may result in unauthorized access to your accounts.

10. Follow the news: Stay up to date with the latest news and events in the world of cryptocurrencies to be aware of possible threats and risks.

By following these guidelines, you can increase the security of your assets when using decentralized exchanges. However, remember that risk is always present, so be careful and attentive when making any financial transactions.

The difference between centralized exchanges and decentralized ones

Cex or Centralized Exchange platforms allow users to trade cryptocurrencies using a centralized management system. On such exchanges, all transactions and storage of cryptocurrencies are carried out through a central server controlled by the exchange operator. Users deposit their cryptocurrency assets into these exchange accounts and then trade them with other users.

Users of these exchanges (CEX) do not have full control over their assets, which exposes them to the risk of losing their assets in case the exchanges are hacked and unable to meet their obligations to users.

Centralized exchanges are vulnerable to hacking, account freezing, and other fraudulent activities. Since all transactions and storage of cryptocurrencies are carried out through a central server, the exchange operator has full control over users' assets. This means that if the server is hacked or the operator decides to freeze users' accounts, users may lose their cryptocurrency assets.

However, it is worth noting that some centralized exchanges take measures to ensure the security and protection of user assets. For example, they may use cold storage to store most of users' funds offline, as well as apply various security measures such as two-factor authentication and identity verification.

Users of these exchanges (CEX) do not have full control over their assets, which exposes them to the risk of losing their assets in case the exchanges are hacked and unable to meet their obligations to users.

Centralized exchanges are vulnerable to hacking, account freezing, and other fraudulent activities. Since all transactions and storage of cryptocurrencies are carried out through a central server, the exchange operator has full control over users' assets. This means that if the server is hacked or the operator decides to freeze users' accounts, users may lose their cryptocurrency assets.

However, it is worth noting that some centralized exchanges take measures to ensure the security and protection of user assets. For example, they may use cold storage to store most of users' funds offline, as well as apply various security measures such as two-factor authentication and identity verification.

In any case, when using centralized exchanges, it is important to be cautious and take measures to protect your cryptocurrency assets, such as using strong passwords, activating two-factor authentication, and storing a significant portion of funds in your own wallets.

Decentralized Exchange or DEX solves this problem by allowing users to exchange cryptocurrencies without the need to transfer their coins to a third party in the form of exchanges.

These platforms allow cryptocurrency trading to be carried out directly between users without the involvement of a central intermediary.

Such exchanges operate on blockchain technology and use smart contracts to automate the trading process and ensure transaction security. On decentralized exchanges, users have full control over their cryptocurrency assets and do not need to trust a central operator.

These platforms allow cryptocurrency trading to be carried out directly between users without the involvement of a central intermediary.

Such exchanges operate on blockchain technology and use smart contracts to automate the trading process and ensure transaction security. On decentralized exchanges, users have full control over their cryptocurrency assets and do not need to trust a central operator.

The main difference between centralized and decentralized exchanges lies in the level of control and security. On centralized exchanges, users trust their cryptocurrency assets to the exchange operator, which can be risky in case of hacking or fraud.

Decentralized exchanges, on the other hand, provide a higher level of security, as users have full control over their assets and transactions. However, decentralized exchanges may be less user-friendly and have limited trading volume compared to centralized exchanges.

Each DEX may differ in blockchain architecture or may be tied to working with certain or different cryptocurrencies. If evaluating cryptocurrency exchanges based on security level, customer crypto assets on DEX are more secure than financial assets of users on centralized crypto exchanges.

The main reason for DEX security is the decentralized blockchain architecture. However, a decentralized cryptocurrency platform client must also go through a complex authentication process.

This is done in the interest of the client himself in order to create a more complex mechanism for protecting the user's financial assets and protecting them from all kinds of fraudulent attacks.

This is done in the interest of the client himself in order to create a more complex mechanism for protecting the user's financial assets and protecting them from all kinds of fraudulent attacks.

Top 15 decentralized exchanges in 2023:

Top 1-5: Biswap / Nomiswap / dYdX / Apex / ApolloX

Top 6-10: OpenOcean / Kine / KyberSwap / MDEX / MM Finance

Top 11-15: OKX DEX / WhiteSwap / Uniswap / PancakeSwap / SushiSwap

Top 1-5: Biswap / Nomiswap / dYdX / Apex / ApolloX

Top 6-10: OpenOcean / Kine / KyberSwap / MDEX / MM Finance

Top 11-15: OKX DEX / WhiteSwap / Uniswap / PancakeSwap / SushiSwap

Risks of decentralized exchanges

Decentralized exchanges also have their own risks. Here are some of them:

1. Low liquidity: Decentralized exchanges usually have lower liquidity compared to centralized exchanges. This means that it may be difficult to find a counterparty for trading, especially for large volumes.

2. High fees: Some decentralized exchanges may charge high fees for executing trades. This may be due to limited liquidity and additional costs for ensuring the security and efficient operation of the platform.

3. Lack of regulation: Decentralized exchanges are usually not regulated by government or financial authorities, which means that users do not have the same level of protection and legal recourse that centralized exchanges may provide.

4. Smart contract vulnerabilities: Decentralized exchanges often use smart contracts to execute trades. However, these smart contracts may contain vulnerabilities that can be exploited by malicious actors for fraud or hacking.

5. Lack of support: Since decentralized exchanges do not have a central operator, users may encounter issues that may be difficult to resolve without support from the platform.

Overall, as with any type of exchange, using decentralized exchanges also requires caution and taking measures to protect one's assets. This may include checking the security of smart contracts, using reliable wallets, and carefully selecting an exchange for trading.

1. Low liquidity: Decentralized exchanges usually have lower liquidity compared to centralized exchanges. This means that it may be difficult to find a counterparty for trading, especially for large volumes.

2. High fees: Some decentralized exchanges may charge high fees for executing trades. This may be due to limited liquidity and additional costs for ensuring the security and efficient operation of the platform.

3. Lack of regulation: Decentralized exchanges are usually not regulated by government or financial authorities, which means that users do not have the same level of protection and legal recourse that centralized exchanges may provide.

4. Smart contract vulnerabilities: Decentralized exchanges often use smart contracts to execute trades. However, these smart contracts may contain vulnerabilities that can be exploited by malicious actors for fraud or hacking.

5. Lack of support: Since decentralized exchanges do not have a central operator, users may encounter issues that may be difficult to resolve without support from the platform.

Overall, as with any type of exchange, using decentralized exchanges also requires caution and taking measures to protect one's assets. This may include checking the security of smart contracts, using reliable wallets, and carefully selecting an exchange for trading.

Safety tips for using decentralized exchanges:

1. Research the exchange: Conduct research on the exchange, read reviews and ratings from other users. Learn about its reputation and security history.

2. Check smart contract security: Before using a decentralized exchange, make sure that the smart contracts used on the platform have undergone security audits. This will help reduce the risk of vulnerabilities and loss of funds.

3. Use reliable wallets: Store your cryptocurrency assets in reliable wallets that support multiple layers of security, such as two-factor authentication and cold storage.

4. Understand the trading process: Understand how the decentralized exchange works and what steps are necessary to execute trades. Make sure you are familiar with the process and do not make mistakes that can lead to loss of funds.

5. Diversify your investments: Do not put all your funds on one decentralized exchange. Diversify your investments and use multiple exchanges to execute trades.

6. Be cautious of phishing: Be careful of fake websites and attempts at fraud. Always check the website URL and make sure you are using an official and secure source.

7. Update software: Make sure you are always using the latest version of software for your wallet and other tools to reduce the risk of vulnerabilities.

8. Use two-factor authentication: Enable two-factor authentication for your accounts on decentralized exchanges to provide an additional level of security.

9. Be cautious of public keys: Never share your public keys or personal information with unverified sources. This can lead to unauthorized access to your accounts.

10. Stay informed: Stay up-to-date on the latest news and events in the cryptocurrency world to be aware of possible threats and risks.

1. Research the exchange: Conduct research on the exchange, read reviews and ratings from other users. Learn about its reputation and security history.

2. Check smart contract security: Before using a decentralized exchange, make sure that the smart contracts used on the platform have undergone security audits. This will help reduce the risk of vulnerabilities and loss of funds.

3. Use reliable wallets: Store your cryptocurrency assets in reliable wallets that support multiple layers of security, such as two-factor authentication and cold storage.

4. Understand the trading process: Understand how the decentralized exchange works and what steps are necessary to execute trades. Make sure you are familiar with the process and do not make mistakes that can lead to loss of funds.

5. Diversify your investments: Do not put all your funds on one decentralized exchange. Diversify your investments and use multiple exchanges to execute trades.

6. Be cautious of phishing: Be careful of fake websites and attempts at fraud. Always check the website URL and make sure you are using an official and secure source.

7. Update software: Make sure you are always using the latest version of software for your wallet and other tools to reduce the risk of vulnerabilities.

8. Use two-factor authentication: Enable two-factor authentication for your accounts on decentralized exchanges to provide an additional level of security.

9. Be cautious of public keys: Never share your public keys or personal information with unverified sources. This can lead to unauthorized access to your accounts.

10. Stay informed: Stay up-to-date on the latest news and events in the cryptocurrency world to be aware of possible threats and risks.

By following these recommendations, you can increase the security of your assets when using decentralized exchanges. However, remember that risk is always present, so be cautious and attentive when conducting any financial transactions.

What is a smart contract?

A smart contract is a programmable contract that allows two parties to establish transaction conditions without the need to trust the execution to any third party.

Smart contracts exist as code in a special registry (blockchain). The registry is managed by a network of computers. Smart contracts in this chain act as intermediaries, guaranteeing the reliability of the transaction.

When working with applications on smart contracts, the user can be sure that the rules are regulated only by the code and no one can change them, including the developers of that code.

How does a smart contract work?

As mentioned earlier, smart contracts are computer protocols or, in simpler terms, computer code. The code is used to input all the conditions of a contract between the parties involved into the blockchain. Once these conditions are met, the smart contract automatically executes the transaction and guarantees that the agreement will be upheld.

Smart contractsallow for the exchange of money, goods, real estate, securities, and other assets. The contract is stored and replicated in a decentralized ledger where information cannot be falsified or deleted. At the same time, data encryption ensures anonymity for the parties involved in the agreement.

An important feature of smart contracts is that they can only work with assets that are within their digital ecosystem.

Advantages of smart contracts:

- Speed.

- Independence.

- Reliability.

- No errors.

What is NFT?

NFT, or Non-Fungible Token, is a unique record in the blockchain - a decentralized database that stores the history of operations with a specific token.

The blockchain itself is essentially a record registry. For example, Bitcoin or Ether are records in the blockchain. NFTs are also records. Like any cryptocurrency, these tokens can be stored in a crypto wallet and used for transactions, buying and selling.

However, there is an important difference. Bitcoins, Ether, other digital currencies, and even real money can easily be replaced by each other and divided into parts. For example, 0.1 Bitcoin or 0.1 Ether, like 0.1 $ are not unique. They can be exchanged for any other 0.1 Bitcoin, 0.1 Ether or 0.1 $.

The blockchain itself is essentially a record registry. For example, Bitcoin or Ether are records in the blockchain. NFTs are also records. Like any cryptocurrency, these tokens can be stored in a crypto wallet and used for transactions, buying and selling.

However, there is an important difference. Bitcoins, Ether, other digital currencies, and even real money can easily be replaced by each other and divided into parts. For example, 0.1 Bitcoin or 0.1 Ether, like 0.1 $ are not unique. They can be exchanged for any other 0.1 Bitcoin, 0.1 Ether or 0.1 $.

NFT cannot be divided into parts or replaced with a similar token. From this point of view, NFT possesses all the characteristics of a unique physical object.

The main feature of NFT is its inability to be replaced, substituted, or have its information altered. This makes it the perfect tool for verifying ownership rights of a digital asset.

NFT certifies that a digital space object belongs specifically to you.

Leading cryptocurrencies by market capitalization

A description of the top ten cryptocurrencies from the experts at Profinvestment.com based on their total value as of January 29, 2023. The order and figures are subject to change, as the cryptocurrency market is highly volatile and any coin can enter or exit the ranking.

1. Bitcoin

Market capitalization - $445,763,438,796

As tradition dictates, the first and most well-known cryptocurrency takes the top spot. Its decentralized digital network was first established in 2009 and has since been considered a flagship that other altcoins look up to.

2. Ethereum

Market capitalization - $191,771,156,746

Second on the list is Ethereum, created by Vitalik Buterin in 2013 and launched in 2015. Its main difference from Bitcoin lies in its full use of smart contracts (which are also available in BTC, but with limited functionality). Additionally, many developers find Ethereum to be a convenient platform for creating decentralized applications.

3. Tether

Market capitalization - $67,225,745,390

A cryptocurrency whose value is equal to the US dollar. Such currencies are called stablecoins and serve to digitize national currencies, eliminating the issue of high volatility while maintaining all the key advantages of electronic money (security, anonymity, borderlessness). Many companies are already partially transitioning from traditional dollars to Tether to take advantage of these benefits, which explains its popularity.

4. USD Coin

Market capitalization - $42,903,875,193

Another stablecoin, second only to Tether among stable coins. It is fully regulated, issued centrally and controlled by US regulatory bodies. There are pros and cons to this approach. The cons are obvious, but the pros are that the degree of coin backing is controlled at the state level. Each USDC is guaranteed to be backed by a US dollar.

5. Binance Coin

Market capitalization - $41,425,070,373

A token issued by the Binance exchange, Binance Coin continues to be popular. Its functionality was initially focused on the ability to save on exchange fees. But over the years, its scope has expanded. To combat inflation, a portion of the tokens are regularly "burned," reducing the volume of assets in circulation.

6. XRP

Market capitalization - $20,833,436,338

Ripple is primarily a cheap and fast payment system. It can be used to exchange currencies, including making cross-border payments. This feature is of particular interest to large companies - for example, Santander and American Express have shown interest in the protocol. Many also note the increased level of network security compared to even Bitcoin. Ripple transactions are fast, and energy consumption is significantly lower.

7. Cardano

Market capitalization - $13,474,561,987

Cardano is a blockchain platform developed based on scientific research; the team consists of many engineers and scientists. The project even has its own philosophy. ADA is actively improved in collaboration with the University of Edinburgh and Lancaster University.

The platform consists of two levels, one of which focuses on working with smart contracts, and the other with tokens. Of course, this is not a unique development, but the platform is being maximally improved to work faster and more reliably.

8. Dogecoin

Market capitalization - $12,215,780,888

DOGE is a meme coin. The coin was created as a parody of other cryptocurrencies, and yet over time it has become one of the most popular, thanks to a powerful and cohesive community.

From a technical point of view, it is similar to Bitcoin, mined through mining, but works much faster and is more suitable for various everyday payments.

9. Polygon

Market capitalization - $10,277,543,356

Polygon (MATIC) is a project founded in 2017, formerly known as Matic Network. The main network was launched in 2020.

Polygon is a second-layer solution for the Ethereum blockchain aimed at scaling the main network and reducing transaction fees that were causing concern for the community at the time. Ethereum is used as the base layer, preserving all its security and functionality, and additional "layers" are used as overlays.

1. Bitcoin

Market capitalization - $445,763,438,796

As tradition dictates, the first and most well-known cryptocurrency takes the top spot. Its decentralized digital network was first established in 2009 and has since been considered a flagship that other altcoins look up to.

2. Ethereum

Market capitalization - $191,771,156,746

Second on the list is Ethereum, created by Vitalik Buterin in 2013 and launched in 2015. Its main difference from Bitcoin lies in its full use of smart contracts (which are also available in BTC, but with limited functionality). Additionally, many developers find Ethereum to be a convenient platform for creating decentralized applications.

3. Tether

Market capitalization - $67,225,745,390

A cryptocurrency whose value is equal to the US dollar. Such currencies are called stablecoins and serve to digitize national currencies, eliminating the issue of high volatility while maintaining all the key advantages of electronic money (security, anonymity, borderlessness). Many companies are already partially transitioning from traditional dollars to Tether to take advantage of these benefits, which explains its popularity.

4. USD Coin

Market capitalization - $42,903,875,193

Another stablecoin, second only to Tether among stable coins. It is fully regulated, issued centrally and controlled by US regulatory bodies. There are pros and cons to this approach. The cons are obvious, but the pros are that the degree of coin backing is controlled at the state level. Each USDC is guaranteed to be backed by a US dollar.

5. Binance Coin

Market capitalization - $41,425,070,373

A token issued by the Binance exchange, Binance Coin continues to be popular. Its functionality was initially focused on the ability to save on exchange fees. But over the years, its scope has expanded. To combat inflation, a portion of the tokens are regularly "burned," reducing the volume of assets in circulation.

6. XRP

Market capitalization - $20,833,436,338

Ripple is primarily a cheap and fast payment system. It can be used to exchange currencies, including making cross-border payments. This feature is of particular interest to large companies - for example, Santander and American Express have shown interest in the protocol. Many also note the increased level of network security compared to even Bitcoin. Ripple transactions are fast, and energy consumption is significantly lower.

7. Cardano

Market capitalization - $13,474,561,987

Cardano is a blockchain platform developed based on scientific research; the team consists of many engineers and scientists. The project even has its own philosophy. ADA is actively improved in collaboration with the University of Edinburgh and Lancaster University.

The platform consists of two levels, one of which focuses on working with smart contracts, and the other with tokens. Of course, this is not a unique development, but the platform is being maximally improved to work faster and more reliably.

8. Dogecoin

Market capitalization - $12,215,780,888

DOGE is a meme coin. The coin was created as a parody of other cryptocurrencies, and yet over time it has become one of the most popular, thanks to a powerful and cohesive community.

From a technical point of view, it is similar to Bitcoin, mined through mining, but works much faster and is more suitable for various everyday payments.

9. Polygon

Market capitalization - $10,277,543,356

Polygon (MATIC) is a project founded in 2017, formerly known as Matic Network. The main network was launched in 2020.

Polygon is a second-layer solution for the Ethereum blockchain aimed at scaling the main network and reducing transaction fees that were causing concern for the community at the time. Ethereum is used as the base layer, preserving all its security and functionality, and additional "layers" are used as overlays.

Polygon aims to solve scalability problems that are currently noticeable for most cryptocurrencies based on Ethereum.

What is Polygon?

The Polygon project is a solution to some of the main problems that Ethereum is facing today, such as high fees, unsatisfactory user interaction, and low transaction throughput.

Polygon is an amazing project in the market in the sense that it is the only scalability solution that supports the Ethereum Virtual Machine (EVM). It allows connected chains to maintain their own security while ensuring compatibility with each other and with the Ethereum main chain. Unlike other similar platforms, chains in the Polygon ecosystem do not have to use their own resources to ensure network operation. At the same time, they can communicate with each other through the ability to transfer messages. This ensures that developers can create active interactions between decentralized applications.

Polygon is an amazing project in the market in the sense that it is the only scalability solution that supports the Ethereum Virtual Machine (EVM). It allows connected chains to maintain their own security while ensuring compatibility with each other and with the Ethereum main chain. Unlike other similar platforms, chains in the Polygon ecosystem do not have to use their own resources to ensure network operation. At the same time, they can communicate with each other through the ability to transfer messages. This ensures that developers can create active interactions between decentralized applications.

Since the Polygon architecture is very similar to the Ethereum architecture, the platform becomes accessible to the world's largest blockchain developer community. Now, Polygon can create highly scalable applications that will use Ethereum's network effects.

According to information from the official Polygon website, there are over 37,000 dapps running on it.

MATIC is the native token of the ecosystem, used to pay for transaction fees and validator rewards. It is an ERC-20 token with a total supply of 10 billion, of which 8.8 billion are currently in circulation.

MATIC is the native token of the ecosystem, used to pay for transaction fees and validator rewards. It is an ERC-20 token with a total supply of 10 billion, of which 8.8 billion are currently in circulation.

MATIC

MATIC is the native token of the ecosystem, used to pay for transaction fees and validator rewards. It is an ERC-20 token with a total supply of 10 billion, of which 8.8 billion are currently in circulation.

The cryptocurrency MATIC is used for various purposes within the Polygon network. MATIC token holders can vote on governance issues and increase network security through staking.

MATIC is necessary as a means of payment for transaction fees and settlements within the Polygon ecosystem. Wallets that support Polygon are compatible with MATIC.

The cryptocurrency MATIC is used for various purposes within the Polygon network. MATIC token holders can vote on governance issues and increase network security through staking.

MATIC is necessary as a means of payment for transaction fees and settlements within the Polygon ecosystem. Wallets that support Polygon are compatible with MATIC.

Cryptocurrency wallets

Top stablecoins (USDT, USDC, BUSD, DAI) are usually located on one of the popular blockchains, without having their own network. The most popular blockchains for this purpose are Ethereum, BNB Chain, Tron, and Polygon.

The choice of wallet, therefore, depends on which network you plan to use when sending and receiving stablecoins, so that the service supports interaction with that network.

Common options for multi-currency wallets with support for popular stablecoins:

The choice of wallet, therefore, depends on which network you plan to use when sending and receiving stablecoins, so that the service supports interaction with that network.

Common options for multi-currency wallets with support for popular stablecoins:

- Trust Wallet

- Atomic

- Exodus

- Metamask

- Coinbase Wallet

- Savl