Royalty NFT

Metaverse

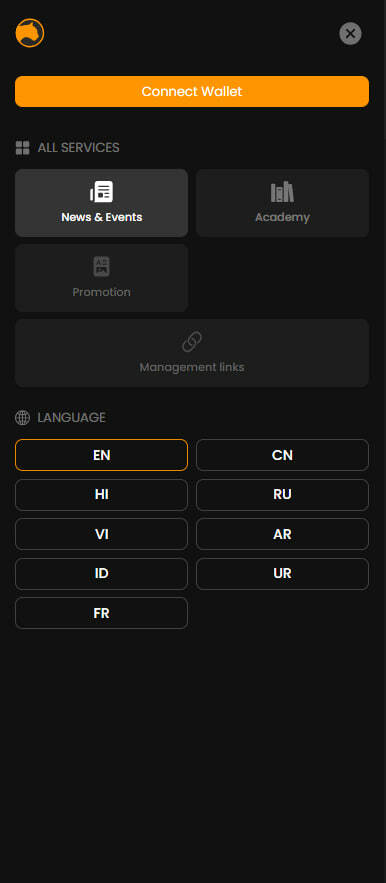

All Services

OTHER

COMING SOON

Management links

COMING SOON

Promotion

ALL SERVICES

LANGUAGE

Style

WHAT IS CRYPTOCURRENCY?

WHAT IS CRYPTOCURRENCY?

Cryptocurrency is a virtual currency based on blockchain technology, which has no physical expression and exists only online.

Before the emergence of cryptocurrencies, to transfer money to another person, one had to rely on an intermediary - a bank. With digital money transfers, no intermediary is needed: cryptocurrency operates on Blockchain technology, which represents a chain of information blocks.

In simply put, cryptocurrencies are not controlled by banks, tax authorities, courts, or government bodies. They cannot influence or control transactions involving cryptocurrencies in any way. The value of cryptocurrencies is also not dependent on any specific country, unlike fiat currencies (which are produced by the government in a desired quantity).

Additionally, all cryptocurrency transactions are irreversible, meaning that once a transaction is made, it cannot be cancelled or revoked.

Additionally, all cryptocurrency transactions are irreversible, meaning that once a transaction is made, it cannot be cancelled or revoked.

First of all, let's define how it can be used.

What is cryptocurrency for?

First, let's define how it can be used.

Cryptocurrency can be used as:

1. A means of payment (to buy goods and services).

2. A tool for earning money (trading).

3. An investment asset (buying promising coins with the goal of earning income in the future or participating in the management of specific projects, similar to stocks).

4. A tool for conducting transactions in decentralized financial networks.

As for investing in cryptocurrency, digital money has generated significant investment interest. Both large investors and ordinary people are investing their money in this rapidly developing market segment. With the right approach, investments in cryptocurrency can bring good profits (but we should not relax too much and remember the possible losses).

2. A tool for earning money (trading).

3. An investment asset (buying promising coins with the goal of earning income in the future or participating in the management of specific projects, similar to stocks).

4. A tool for conducting transactions in decentralized financial networks.

As for investing in cryptocurrency, digital money has generated significant investment interest. Both large investors and ordinary people are investing their money in this rapidly developing market segment. With the right approach, investments in cryptocurrency can bring good profits (but we should not relax too much and remember the possible losses).

The history of the emergence of cryptocurrencies is as follows:

In 2009, the first digital coin, Bitcoin, appeared. However, the technology on which it is built has even deeper roots. Earlier attempts were made to create digital currencies with encrypted registries. Examples of such projects are B-Money and Bit Gold, whose mechanisms of operation were fully described but never developed.

In 2008, information about Bitcoin first appeared on the Internet. A person named Satoshi Nakamoto, whose identity remains unknown to this day, published a document titled "Bitcoin: A Peer-to-Peer Electronic Cash System."

In 2008, information about Bitcoin first appeared on the Internet. A person named Satoshi Nakamoto, whose identity remains unknown to this day, published a document titled "Bitcoin: A Peer-to-Peer Electronic Cash System."

The document was posted on a cryptography discussion mailing list. In 2009, the official launch of the first cryptocurrency, Bitcoin, took place: on January 3rd, the first block and the first 50 BTC coins were generated, and the first transaction in the network occurred on January 12th. This is also when mining began - the process of mining new bitcoins.

As the idea of decentralized and encrypted currencies becomes more popular, the first alternative cryptocurrencies (altcoins) appear. They usually copy the main idea embedded in Bitcoin but try to improve it by offering greater speed, anonymity, and other advantages. The first altcoins were Namecoin and Litecoin, which appeared in 2009.

As the idea of decentralized and encrypted currencies becomes more popular, the first alternative cryptocurrencies (altcoins) appear. They usually copy the main idea embedded in Bitcoin but try to improve it by offering greater speed, anonymity, and other advantages. The first altcoins were Namecoin and Litecoin, which appeared in 2009.

In 2015, Ethereum was introduced, bringing many new features to the industry, including smart contracts and initial coin offerings (ICO). Enthusiasm around the platform grew, and in 2016, the coin came close to stealing the spotlight from Bitcoin.

However, the period of rapid growth was followed by a crash. This event was marked by the Great Crypto Crash of 2018: in the first quarter of the year, most cryptocurrencies significantly dropped in price. For example, in just one month (from January 6th to February 6th, 2018), Bitcoin decreased by 65%. Thus, 2018 was spent mourning for Bitcoin and the cryptocurrency market as a whole.

In 2019, the cryptocurrency industry underwent a transformation, transitioning from an underground business to an integral part of the global financial system. In the spring, cryptocurrencies began to demonstrate exponential growth, and Binance Coin, the internal token of the largest exchange Binance, became a leader in growth

In 2019, the cryptocurrency industry underwent a transformation, transitioning from an underground business to an integral part of the global financial system. In the spring, cryptocurrencies began to demonstrate exponential growth, and Binance Coin, the internal token of the largest exchange Binance, became a leader in growth

Thus, cryptocurrencies gradually started integrating into the global financial system and gaining wider adoption.

Billionaires and major institutional investors began actively investing in them. 2020 marked the beginning of a new cycle of cryptocurrency growth. One of the drivers of cryptocurrency price growth was the halving of Bitcoin, which occurred in May 2020. The reward miners receive for mining a coin decreased from 12.5 to 6.25 BTC. Overall, despite the escalation of the coronavirus pandemic, 2020 was a year of cryptocurrency growth.

In 2021, the cryptocurrency market capitalization grew by almost 200%, reaching a value of around $2.3 trillion. This year also saw a historical peak in Bitcoin price, surpassing $68,000 per coin.

Billionaires and major institutional investors began actively investing in them. 2020 marked the beginning of a new cycle of cryptocurrency growth. One of the drivers of cryptocurrency price growth was the halving of Bitcoin, which occurred in May 2020. The reward miners receive for mining a coin decreased from 12.5 to 6.25 BTC. Overall, despite the escalation of the coronavirus pandemic, 2020 was a year of cryptocurrency growth.

In 2021, the cryptocurrency market capitalization grew by almost 200%, reaching a value of around $2.3 trillion. This year also saw a historical peak in Bitcoin price, surpassing $68,000 per coin.

As we can see, Bitcoin and other cryptocurrencies have not been stable for most of their history. The first cryptocurrency still remains dominant: Bitcoin "rules the world" and is more valuable than other coins. However, over the past year, the value of some altcoins has grown by thousands or even tens of thousands of percent, allowing them to enter the top rankings by market capitalization and establish themselves there.According to experts, in 2023, many promising altcoins will strengthen their positions and attempt to dethrone Bitcoin from its top spot on the pedestal.

Cryptocurrencies have a lot in common with traditional fiat currencies

Both can be used for payments and as a means of saving. In both cases, trust from users is required for them to function as a medium of exchange.

However, digital currencies offer features that the traditional monetary system cannot currently provide (which is why cryptocurrency is called the "currency of the future").

First and foremost, there is decentralization: cryptocurrency is not controlled by any government or centralized authority, allowing for direct transactions without intermediaries. Unlike fiat currency, which is fully controlled by banks and governments.

First and foremost, there is decentralization: cryptocurrency is not controlled by any government or centralized authority, allowing for direct transactions without intermediaries. Unlike fiat currency, which is fully controlled by banks and governments.

Fiat currency refers to commodity money, which derives its value from being declared legal tender by the government (they have no intrinsic value).

Therefore, if anyone can receive and spend cryptocurrency anywhere, anytime, worldwide, without the need for a bank or government, fiat money is under the control of the state. And the central bank can issue as many banknotes and coins as it deems necessary.

Thus, Bitcoin, as the first cryptocurrency, created a new form of trust in the financial system. The underlying system of digital money is completely transparent, based on mathematics and the actual consent of users.

Fiat currency remains the dominant form of money, but cryptocurrencies represent the next step in their evolution.

Thus, Bitcoin, as the first cryptocurrency, created a new form of trust in the financial system. The underlying system of digital money is completely transparent, based on mathematics and the actual consent of users.

Fiat currency remains the dominant form of money, but cryptocurrencies represent the next step in their evolution.

Forms of Cryptocurrencies

Digital currency is divided into coins and tokens. Some people mistakenly equate these two concepts, which is misleading. Let's understand how coins differ from tokens (this is important).

A coin is the monetary unit of a cryptocurrency project that operates on its own blockchain. Coins are mined through mining. They can be easily transferred to other users of the system, used to pay for goods and services, and sold for fiat currencies.

All coins except Bitcoin are called altcoins

A token is the monetary unit of a cryptocurrency project that operates on an existing blockchain. Tokens cannot be mined; they can only be bought or obtained as a reward for certain activities.

Tokens cannot be used as payment for goods or services; their main function is to provide access to the features of the cryptocurrency platform. Tokens are also used as investment instruments and can be used for voting or surveys.

Tokens can be exchanged for fiat currency or other cryptocurrencies, but they need to be withdrawn to an exchange for that. Unlike coins that operate on the Bitcoin blockchain, most tokens operate on the Ethereum blockchain.

Tokens cannot be used as payment for goods or services; their main function is to provide access to the features of the cryptocurrency platform. Tokens are also used as investment instruments and can be used for voting or surveys.

Tokens can be exchanged for fiat currency or other cryptocurrencies, but they need to be withdrawn to an exchange for that. Unlike coins that operate on the Bitcoin blockchain, most tokens operate on the Ethereum blockchain.

In simple terms, if we make an analogy with real life, coins can be compared to banknotes or coins, while tokens can be compared to a pass that opens up certain possibilities.

Types of cryptocurrencies

All existing digital assets are issued for one purpose or another. There are 7 main types of cryptocurrencies: payment cryptocurrencies, platform tokens, exchange tokens, stablecoins, utility coins, security token analogs, and crypto goods.